Don't go into the mortgage process underpowered

Now you can find the best home loan option for your unique situation

We're empowering new home buyers, lifelong renters, and homeowners to explore all their options from the comfort of their home. After all, a well-informed borrower gets the right loan program and the best pricing. Best of all, it's completely free to use.

Meet loanSMART

Our Simulated Mortgage Approval in Real-Time (SMART) discovers all your best home loan options BEFORE you meet with a mortgage company.

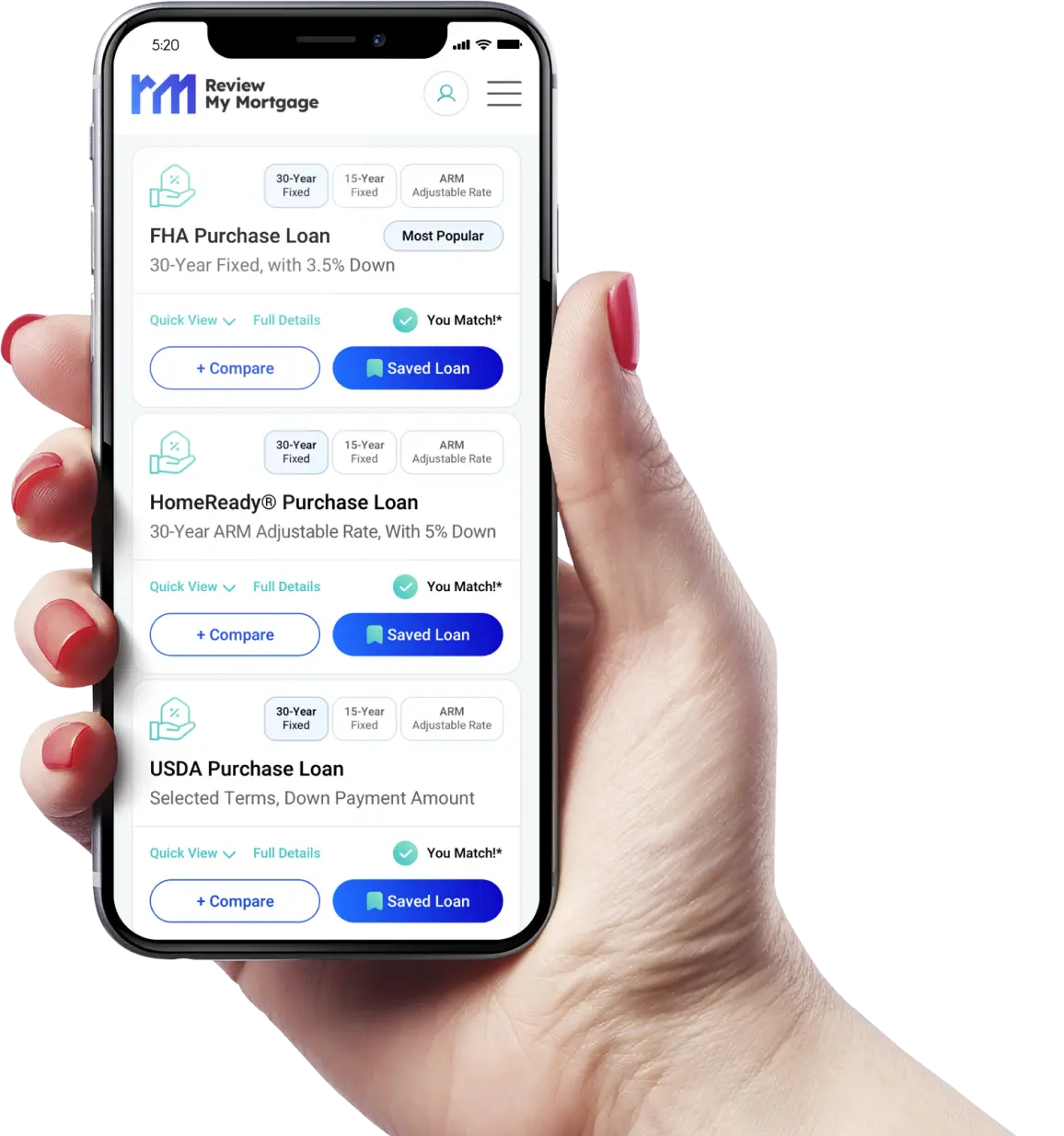

Loan Match System

Your borrower profile is compared to the qualification factors of all local loan program options to find your relevant matches.

Sorted Prioritization

Your loan matches are then sorted and prioritized based on your homeownership goals, location, and current situation.

Save & Compare

Compare different home loan matches, including adjustments to down payment and mortgage length options within the same loan.

Expanded Options

100% financing bonds, renovation, cash-out, first time homebuyer, professional, and other specialty loan types are all included in your simulation.

I’m ready to start my mortgage review

5 Minutes to Home Loan Happiness

Instant access to the nation's largest database of mortgage programs

Home Purchase Options

Refinancing Options

Mortgage Education Center

By Akash Akash

Iowa Housing Professionals Gather to Focus on Expanding Housing Opportunities

Housing professionals from across Iowa gathered at the Iowa Finance Authority’s Housing Iowa Conference in Des Moines to address housing challenges and opportunities. Governor Kim Reynolds spoke about the state's efforts to assist Iowans in recovering from recent tornadoes and flooding, which damaged over 5,000 homes. She highlighted the ongoing commitment to rebuilding and expanding housing opportunities for all residents.

Read More

By Akash Akash

Houston Housing Market: Trends, Prices, and Forecast for 2024-2025

The Houston housing market continues to evolve in 2024, facing challenges like rising interest rates and fluctuating buyer behavior. Despite disruptions, the market has shown resilience, with increasing sales in the luxury segment and steady price growth. This report explores the latest housing trends, key market takeaways, and predictions for 2024-2025. With a focus on home prices, inventory, and the impact of mortgage rates,we dive into what potential buyers and investors can expect in Houston

Read More

By Akash Akash

U.S. 30-Year Mortgage Rates Hold at 6.35% as Fed’s Interest Rate Cut Looms

The average rate for a 30-year mortgage in the U.S. remains unchanged at 6.35% this week, according to Freddie Mac. This comes ahead of the Federal Reserve’s expected interest rate cut later this month. While 15-year fixed mortgage rates saw a slight drop to 5.47%, both rates remain lower than the highs seen last year. The ongoing high mortgage rates are influencing the housing market, as would-be buyers stay cautious.

Read More

By Akash Akash

Homebuyers Await Fed’s Next Move as Mortgage Rates Hold Steady at 6.35%

Though mortgage rates remain steady at 6.35% this week, many homebuyers are hesitating to enter the market while waiting for the Federal Reserve’s upcoming decision on interest rates. Some buyers, however, are acting quickly in anticipation of a fall rush. Mortgage applications rose by 3%, though they remain 4% lower compared to a year ago. While rates are significantly lower than last year’s highs above 7%, climbing home prices and hopes for further rate reductions make some buyers cautious.

Read MoreLatest from the Blog

Are you a mortgage professional?

Learn about our unique sponsorships, including RMM PROLender, that can take your production to the next level.

Get in Touch