Don't go into the mortgage process underpowered

Now you can find the best home loan option for your unique situation

We're empowering new home buyers, lifelong renters, and homeowners to explore all their options from the comfort of their home. After all, a well-informed borrower gets the right loan program and the best pricing. Best of all, it's completely free to use.

Meet loanSMART

Our Simulated Mortgage Approval in Real-Time (SMART) discovers all your best home loan options BEFORE you meet with a mortgage company.

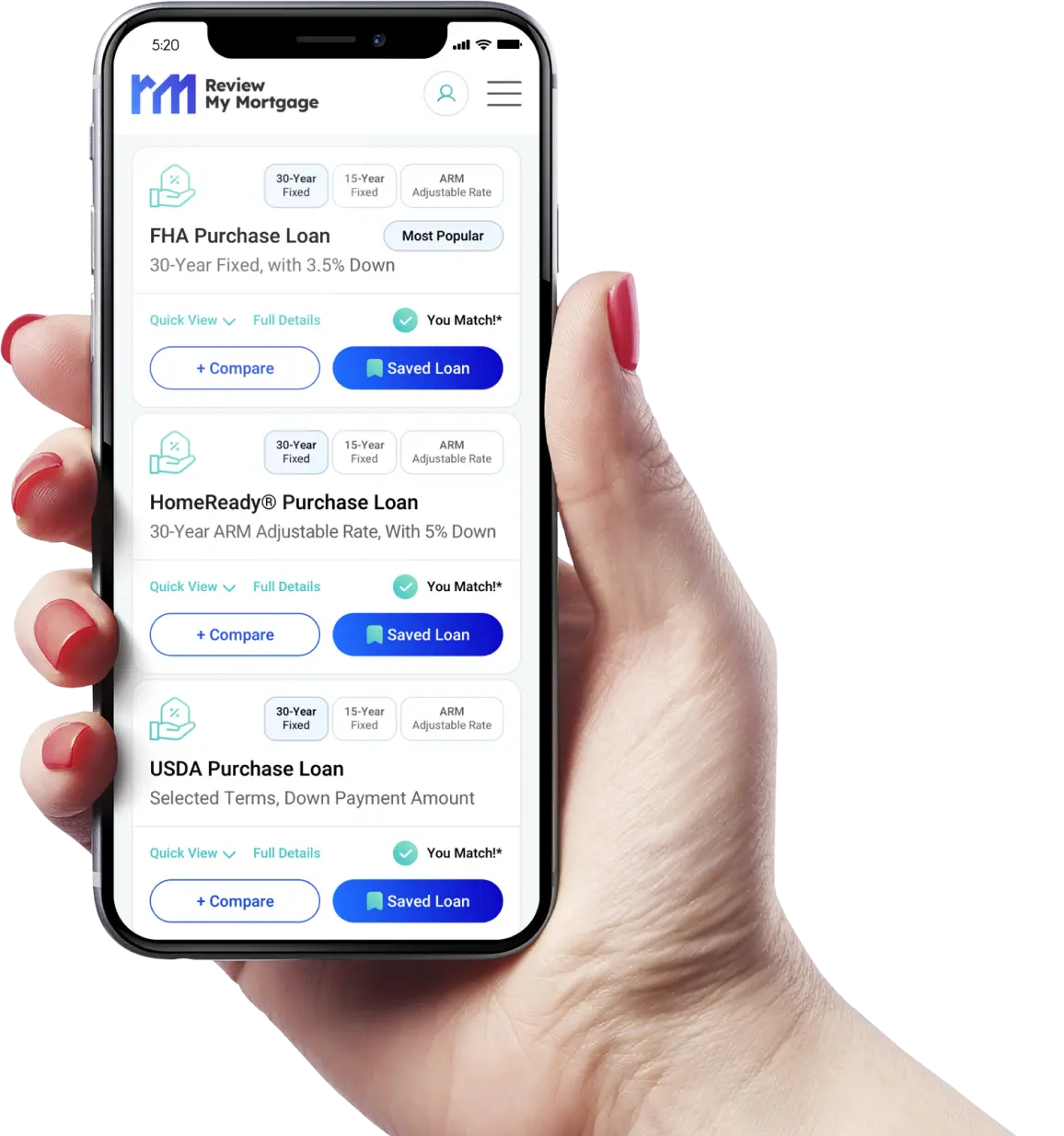

Loan Match System

Your borrower profile is compared to the qualification factors of all local loan program options to find your relevant matches.

Sorted Prioritization

Your loan matches are then sorted and prioritized based on your homeownership goals, location, and current situation.

Save & Compare

Compare different home loan matches, including adjustments to down payment and mortgage length options within the same loan.

Expanded Options

100% financing bonds, renovation, cash-out, first time homebuyer, professional, and other specialty loan types are all included in your simulation.

I’m ready to start my mortgage review

5 Minutes to Home Loan Happiness

Instant access to the nation's largest database of mortgage programs

Home Purchase Options

Refinancing Options

Mortgage Education Center

By Akash Akash

August Predictions: Potential Drops in Mortgage Interest Rates

With mortgage rates significantly higher than the lows of 2020 and 2021, potential homebuyers are keenly observing market trends for any signs of decrease. Here's a look at three possible scenarios in August 2024 that could see mortgage rates fall, providing a much-needed break for buyers in today's expensive housing market.

Read More

By Akash Akash

Evolution of U.S. Mortgage Rates: 1970s to 2024

This article explores the historical trends of U.S. mortgage rates from the 1970s to the present, highlighting significant changes and their economic implications. From the inception of the 30-year fixed-rate mortgage to current rates resembling those of the late 1990s, the journey reveals the impact of economic policies, inflation, and other factors on mortgage rates.

Read More

By ReviewMyMortgage Admin

Promising Inflation Trends May Lower Future Mortgage Rates

Recent inflation data suggests a potential decrease in mortgage rates, providing hope for homebuyers facing high borrowing costs. This article explores the implications of the latest Consumer Price Index report on future mortgage rates and the overall housing market.

Read More

By ReviewMyMortgage Admin

Limited Relief for Homebuyers in Late 2024: Market Insights

The second half of 2024 doesn’t bring much relief for prospective homebuyers, as economists predict a stagnant situation with high mortgage rates and tight housing supplies. This article dives into the economic forecasts suggesting minimal improvement in housing affordability and market fluidity, examining the factors influencing these trends.

Read MoreLatest from the Blog

Are you a mortgage professional?

Learn about our unique sponsorships, including RMM PROLender, that can take your production to the next level.

Get in Touch